By Pepper Fisher

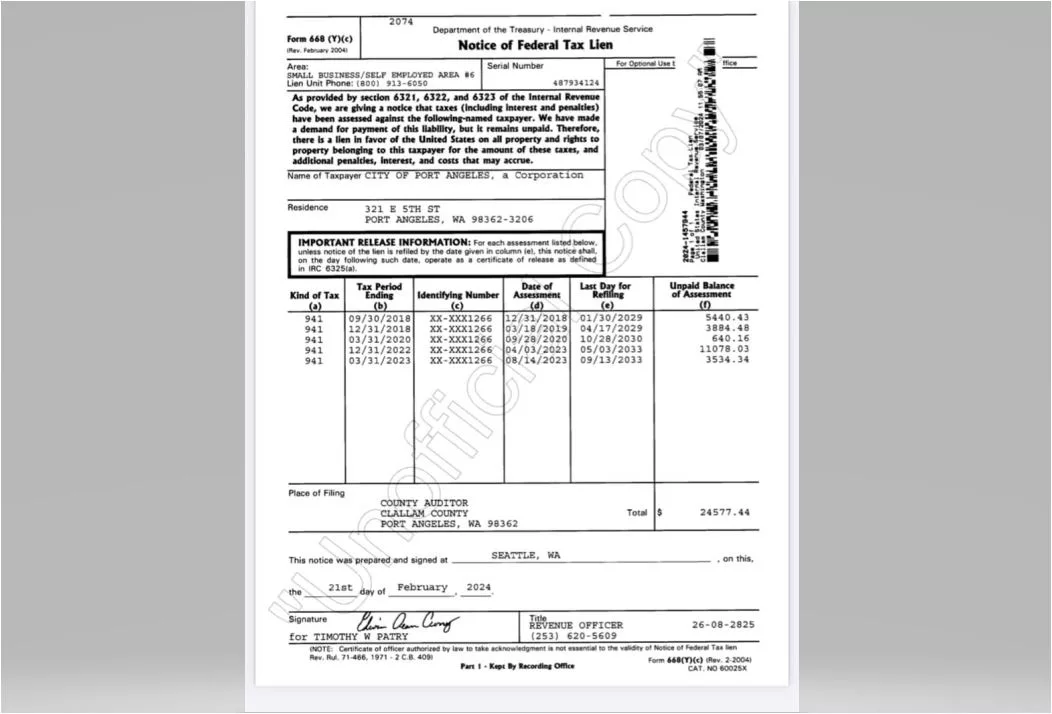

PORT ANGELES – We saw that someone recently posted on social media what appeared to be an official Federal Tax Lien from the Internal Revenue Service, claiming that the City of Port Angeles owed over $24,000 in back taxes, going back to 2018.

Because this lien is posted on social media, we felt it was important to get some answers to clear up any misconceptions.

We reached out to city officials to see if they could confirm whether the lien was legitimate or a fake, and what information they could supply.

Here is the reply we received from Communications Coordinator Jessica Straits on Tuesday.

“Thanks again for your patience and for reaching out. It is important to clarify that the City of Port Angeles is fully compliant with all tax obligations and does not owe any back taxes. The City’s Finance Department has been in touch with the IRS, and the lien is completely unwarranted.

Prior to this, the IRS imposed erroneous fines and penalties on the City for failure to submit files, but those files had, in fact, already been submitted and the taxes had been paid on time. Unfortunately, the IRS misplaced those original files and subsequently imposed erroneous fines and penalties without any notice to the City.

Once notification of this issue was finally received, the City provided the necessary files to the IRS that demonstrated compliance and payment of all required taxes.

The City also requested abatement of the fines and penalties. The IRS has acknowledged the fines were imposed due to this error; however, they placed a lien on City property without notification and in spite of the City’s continued efforts to resolve this matter.

Despite acknowledging their own bureaucratic mistakes, the IRS has been very careless and slow in resolving a matter they caused. The City expects that this matter will be resolved shortly.

Please let us know if you have any additional questions.”